Top Conditions That Qualify You for SSI and SSDI—and Which Program Is Right for You

Top Conditions That Qualify You for SSI and SSDI—and Which Program Is Right for You

Living with a disability can be challenging enough without the added burden of financial stress. Fortunately, the Social Security Administration (SSA) offers two major programs to provide support to individuals who can no longer work due to a disabling condition: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). But not all medical conditions automatically qualify—and the requirements for each program differ.

In this guide, we’ll walk you through:

- The difference between SSI and SSDI

- Who qualifies for each program

- The top medical conditions that are most likely to be approved for benefits

- What you need to know to improve your chances of getting approved

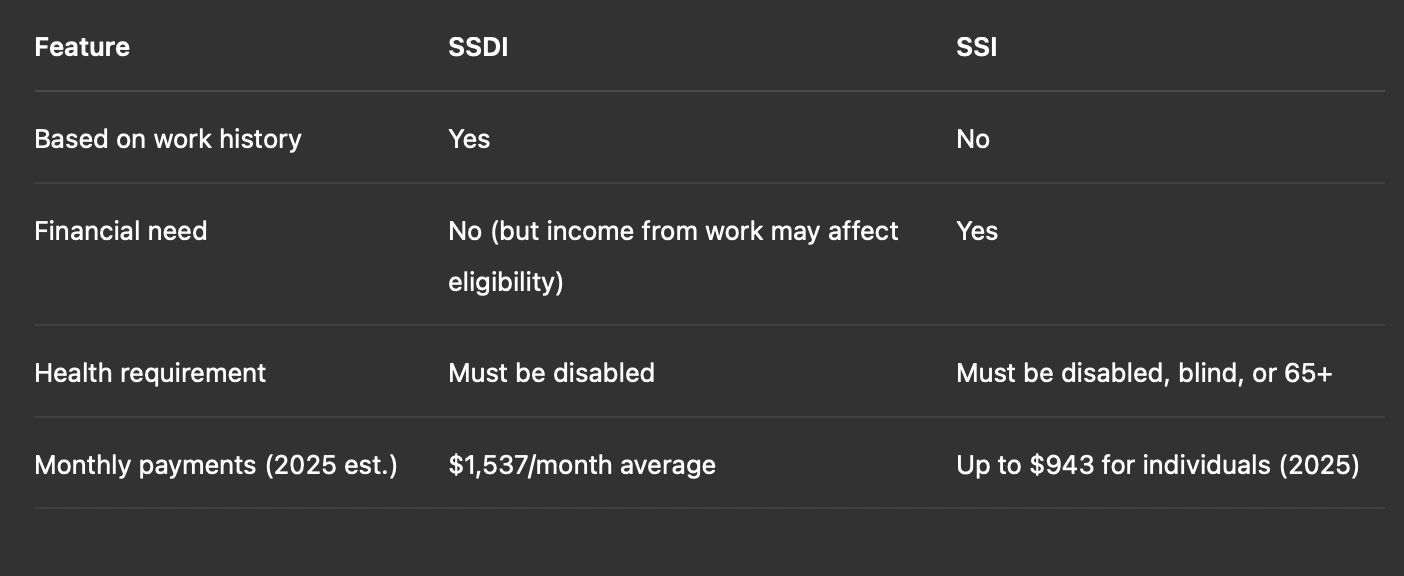

SSI vs. SSDI: What’s the Difference?

Social Security Disability Insurance (SSDI) is designed for people who have worked and paid Social Security taxes but are now unable to work due to a disabling condition. It’s based on your work history—not your financial situation.

Supplemental Security Income (SSI) is a needs-based program for individuals who are disabled, blind, or aged 65 and older with very limited income and resources. You don’t need a work history to qualify, but your assets and monthly income must fall below a certain threshold.

Who Qualifies for SSDI?

To be eligible for SSDI, you must:

- Have a qualifying disability listed by the SSA or deemed equally severe

- Be unable to perform substantial gainful activity (SGA) (in 2025, this means earning less than $1,550/month if non-blind, or $2,590/month if blind)

- Have worked and paid Social Security taxes for enough years (typically 5 out of the last 10)

Who Qualifies for SSI?

To be eligible for SSI, you must:

- Be disabled, blind, or age 65+

- Have limited income (wages, pensions, etc.)

- Have limited resources (less than $2,000 in assets for individuals; $3,000 for couples)

- Be a U.S. citizen or meet certain legal residency requirements

The Top Conditions That Qualify for SSDI and SSI

While the SSA maintains a list of impairments called the “Blue Book,” many people with conditions not listed still qualify. Below are some of the most commonly approved categories of disabling conditions.

1. Musculoskeletal Disorders

These include conditions that impact the bones, joints, and muscles—often the result of injury, arthritis, or degeneration.

Examples:

- Degenerative disc disease

- Osteoarthritis

- Scoliosis

- Chronic back pain

- Fibromyalgia (if properly documented)

Why It Qualifies: If your ability to walk, sit, stand, or lift is significantly impaired—even with treatment—these conditions can meet SSA’s definition of disability.

2. Mental Health Disorders

Mental conditions are among the most frequent causes of disability claims. While harder to “see,” they can be just as debilitating as physical illnesses.

Examples:

- Depression

- Bipolar disorder

- Schizophrenia

- Anxiety disorders

- PTSD

- Autism spectrum disorders

- Intellectual disabilities

Why It Qualifies: If your mental condition prevents you from maintaining attention, concentrating, interacting socially, or adapting to workplace stress, you may qualify.

3. Neurological Disorders

Neurological conditions affect the brain, spine, and nerves and often have unpredictable symptoms and progression.

Examples:

- Epilepsy (especially uncontrolled seizures)

- Multiple sclerosis (MS)

- Parkinson’s disease

- Traumatic brain injury

- Cerebral palsy

Why It Qualifies: These disorders can severely limit your mobility, coordination, or ability to focus—especially if medication doesn’t fully control symptoms.

4. Cardiovascular Conditions

Heart problems can severely restrict your physical capacity to work.

Examples:

- Congestive heart failure

- Coronary artery disease

- Arrhythmias

- Peripheral artery disease

Why It Qualifies: If your heart condition limits your ability to walk or carry out daily activities—or puts you at risk of life-threatening complications—SSA may consider you disabled.

5. Respiratory Disorders

Chronic lung and breathing conditions can also make it impossible to perform even light work.

Examples:

- COPD (Chronic Obstructive Pulmonary Disease)

- Chronic asthma

- Pulmonary fibrosis

- Cystic fibrosis

- Lung cancer

Why It Qualifies: If your lung capacity is low, you need oxygen support, or you’re frequently hospitalized, these conditions may support a disability claim.

6. Autoimmune and Inflammatory Disorders

These illnesses can cause unpredictable flares and long-term damage to joints and organs.

Examples:

- Lupus

- Rheumatoid arthritis

- Crohn’s disease

- Ulcerative colitis

- Sjögren’s syndrome

Why It Qualifies: If fatigue, joint pain, or organ damage prevents you from maintaining steady work—even during symptom-free periods—you could be eligible.

7. Cancer

Certain types of cancer qualify automatically under the SSA’s Compassionate Allowances program. Others require documentation of severity or treatment effects.

Examples:

- Lung cancer

- Breast cancer (advanced stages)

- Leukemia

- Pancreatic cancer

- Brain cancer

Why It Qualifies: Advanced or aggressive cancers, especially those requiring extensive treatment, often qualify due to their life-altering impact.

8. Sensory Disorders

If your vision or hearing loss prevents you from performing tasks safely or communicating effectively, you may qualify.

Examples:

- Blindness (partial or complete)

- Hearing loss (with or without aids)

- Speech and language disorders

Why It Qualifies: The SSA has specific tests and thresholds for determining how impairments in vision, hearing, or speech affect work capacity.

9. Endocrine Disorders

Some hormone-related conditions severely affect metabolism, energy, or bodily function.

Examples:

- Diabetes (with severe complications)

- Thyroid disorders

- Adrenal gland disorders

Why It Qualifies: Diabetes alone doesn’t usually qualify—but if it causes complications like neuropathy, kidney failure, or vision loss, you may be eligible.

10. Digestive System Disorders

These involve chronic issues with digestion, absorption, or the elimination of waste.

Examples:

- Inflammatory bowel disease (IBD)

- Liver disease (e.g., cirrhosis)

- Short bowel syndrome

Why It Qualifies: Frequent hospitalization, malnutrition, or an inability to maintain a normal schedule can all be evidence of disabling impact.

What If Your Condition Isn’t Listed?

Even if your exact condition isn’t on the SSA’s Blue Book, you may still qualify if the overall impact of your symptoms prevents you from working.

For example:

- A combination of multiple lesser conditions may be disabling

- “Residual Functional Capacity” (RFC) evaluations can show your limitations

- Doctor’s notes, imaging, treatment records, and consistent medical history are all critical

Can You Qualify for Both SSI and SSDI?

Yes, some people qualify for both—this is known as “concurrent benefits.” You may qualify for SSDI based on work history and SSI if your SSDI payment is low enough due to limited work credits or low earnings.

How to Strengthen Your Claim

If you’re applying for SSI or SSDI, keep these key tips in mind:

- Get Regular Medical Treatment

- The SSA puts a lot of weight on recent, ongoing treatment from licensed providers.

- Follow Your Doctor’s Orders

- Ignoring treatment recommendations can hurt your case.

- Be Detailed in Your Application

- Don’t just list your condition—explain how it limits your daily life and job functions.

- Don’t Delay Your Appeal

- If you’re denied, appeal quickly. Most claims are denied at first but won later on appeal—especially with legal help.

Final Thoughts: Don’t Give Up

Thousands of people every year give up on their SSI or SSDI applications because they think their condition isn’t “bad enough” or they’re overwhelmed by paperwork.

But here’s the truth:

- The majority of approved claims are won on appeal, not the first try.

- Using a qualified disability lawyer can increase your chances by more than 7X.

- There’s no fee unless you win your case.

So don’t give up hope—and don’t try to go it alone.

Need Help Winning Your Disability Claim?

At GetMyALDisability.com, we specialize in helping Alabama residents get the SSI and SSDI benefits they deserve. We’ll handle your appeal, paperwork, and communication with the SSA—so you don’t have to leave your home.

Contact us today for a free case review.

Why Getting Your Medical Records in Order Is Crucial for Winning a Social Security Disability Appeal